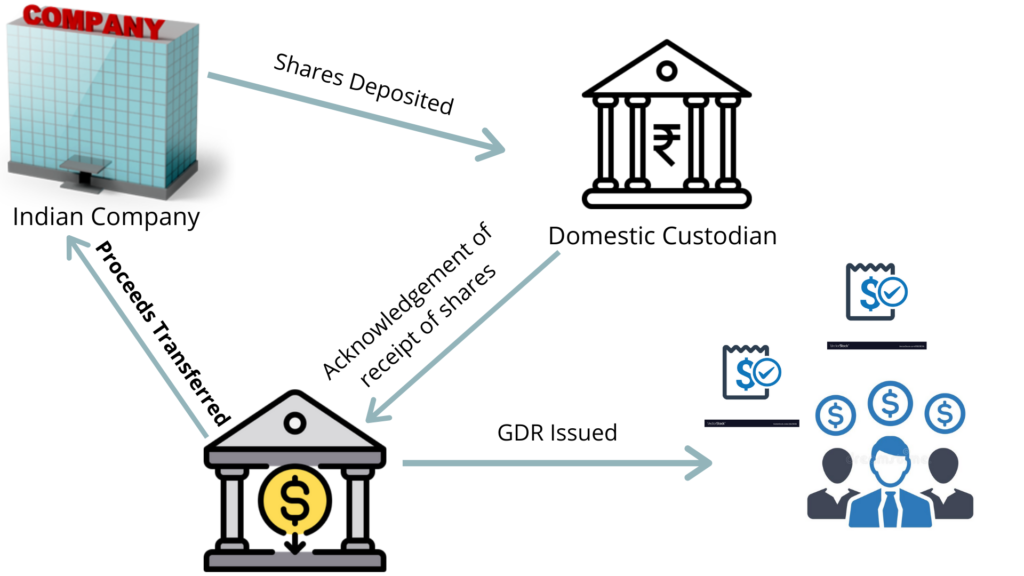

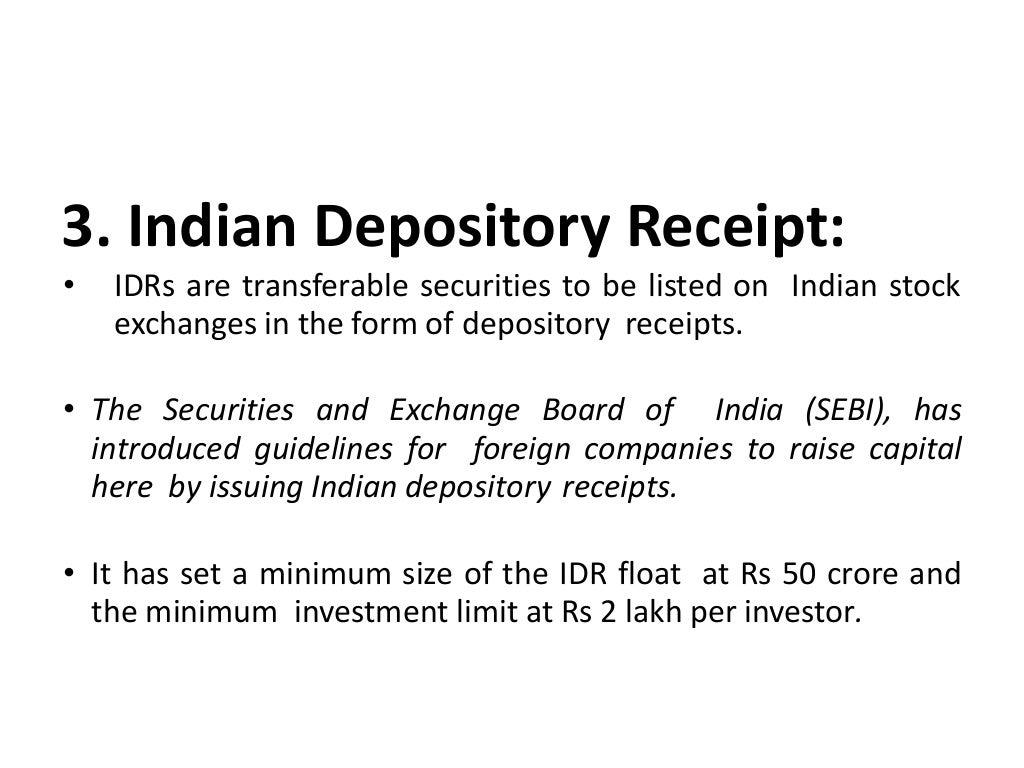

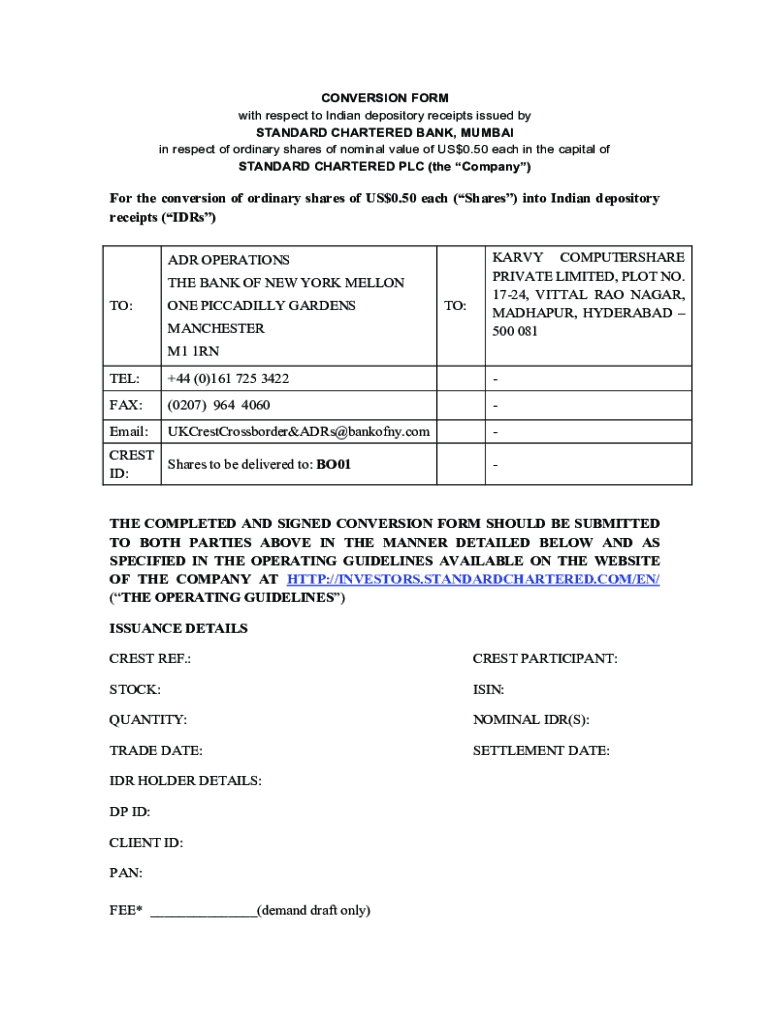

The introduction of Indian Depository Receipts (IDRs) in the Indian market is a hope for people to make money for the long term. These Depository Receipts are like equity shares but with subtle differences. The Indian Government initiated the IDR to globalize the Indian capital market and to allow entry of local investors in foreign companies.. As per the definition given in the Companies (Issue of Indian Depository Receipts) Rules, 2004, IDR is an instrument in the form of a Depository Receipt created by the Indian depository in India against the underlying equity shares of the issuing company. An IDR is a way for a foreign company to raise money in India.

Understanding Indian Depository Receipts And Their Benefits Investing Jargon

PPT Presented By Nitin Agarwal PowerPoint Presentation, free download ID2410908

Indian Depository Receipt PDF Stock Market Equity Securities

Procedure for Initial Public Offer of Indian Depository Receipts (IDRs) Lawrbit

Understanding Indian Depository Receipts And Their Benefits Investing Jargon

Depositary Receipt India Dictionary

Depository Receipts PDF American Depositary Receipt Economies

Global Depository Receipts A boon or a bane? The Financial Pandora

What is Depository Receipt BMR YouTube

Understanding Indian Depository Receipts And Their Benefits Investing Jargon

PPT Indian Depository Receipts (IDR) PowerPoint Presentation, free download ID2561248

What is Depository Receipts ? Depository Receipts అంటే ఏమిటి? La Excellence YouTube

Depository Receipts Indian Economy Free PDF Download

Indian Depository Receipts Class 11 IDRs Sources of Business Finance Business Studies Class

What Are Global Depository Receipts iPleaders

depository receipts

Fillable Online Indian Depository Receipt A gateway to overseas entities Fax Email Print

What is Depository receipt Types by Dr. Mihir C. Shah YouTube

Meaning, Features, Process of Indian Depository Receipts / IDRs YouTube

What is Global Depository Receipt ? Global Depository Receipt అంటే ఏమిటి? La Excellence

An IDR is a depository receipt denominated in Indian rupees issued by a domestic depository in India. Much like an equity share, it is an ownership pie of a company. Since foreign companies are.. Indian Depository Receipt - A Basic Guide. In the Indian financial landscape, the Indian Depository Receipt (IDR) is a key tool that's been catching the eye for a while now. Introduced back in 2004 by SEBI, IDR offers a route for domestic companies to tap into the international markets by listing their shares on global stock exchanges.