INCOME TAX ASSESSMENT ACT 1997 - SECT 8.1. General deductions. (1) You can deduct from your assessable income any loss or outgoing to the extent that: (a) it is incurred in gaining or producing your assessable income; or. (b) it is necessarily incurred in carrying on a * business for the purpose of gaining or producing your assessable income.. Section 8-1 of Income Tax Assessment Act 1997 (ITAA 1197) allows a deduction for all losses and outgoings to the extent to which they are incurred in gaining or producing assessable income, except where the outgoings are of a capital, private or domestic nature, or relate to the earning of exempt income.

Assessment Procedure under the Tax Act, 1961

Sports Development Act 1997 Tax Relief greenasc

Tax Assessment Act 1997 DOC

The Tax Assessment Act 1997 Study

Tax Assessment Act (ITAA) 1997 Assignment on Deductions

Section 139, Act, 19612019 PROCEDURE FOR ASSESSMENT upload form16

Section 11 Tax Act Exemptions for Charitable Trusts

Tax Assessment Act LLC USA

Know About disallowance under Section 43B in Tax Act 1961

Section13 OF THE TAX ACT

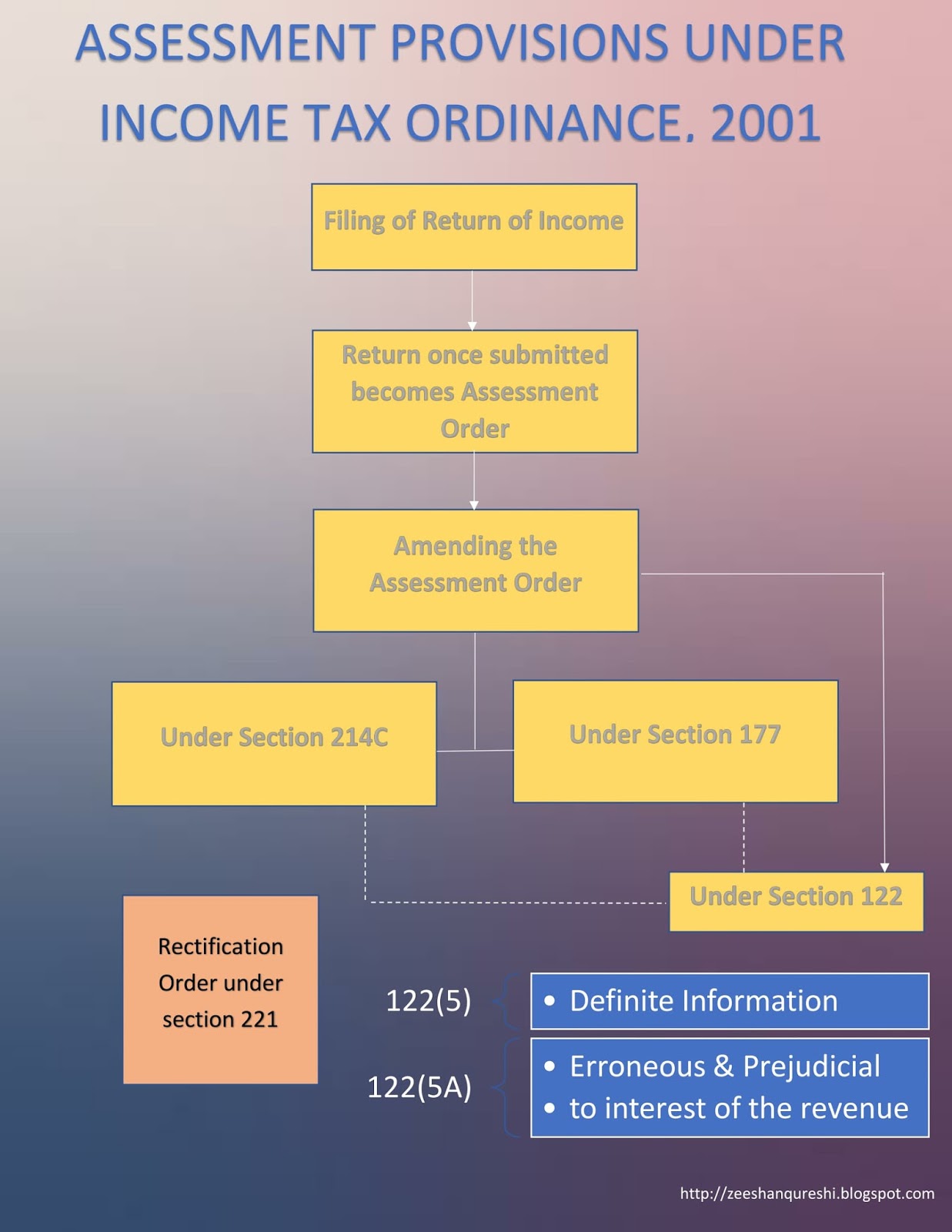

ASSESSMENT PROCEDURES UNDER THE TAX ORDINANCE, 2001

Different types of Tax Assessments under the Tax Act

Tax Act 13 notes on law of taxation PART THE TAX ACT, 1961 Topic

Tax Assessment Act (ITAA) 1997 Assignment on Deductions

MIKIPEDIA LAW BLOG TAX ASSESSMENT ACT 1997 SECT 960.100

Section 115BAC of Tax Act IndiaFilings

Section 194A of Tax Act Sorting Tax

Section 281 of Tax Act Guidelines and Details

Section 115BA 2022 Guide On Section 115BA Of The Tax Act

Section 144C of the Tax Act A Comprehensive Guide and FAQs

Summary - what this Ruling is about. 1. This Ruling sets out when an employee can deduct a work expense under section 8-1 of the Income Tax Assessment Act 1997. For the purposes of this Ruling, 'work expense' means 'a loss or outgoing you incur in producing your salary or wages'.. Income Tax Assessment Act 1997 No. 38, 1997Compilation No. 248 Compilation date:1 January 2024 Includes amendments:Act No. 40, 2023, Act No. 61, 2023, Act No. 69, 2023, Act No. 101, 2023 and Act No. 103, 2023 Registered:15 January 2024 This compilation is in 12 volumes Volume 1: sections 1-1 to 36-55 Volume 2: sections 40-1 to 67-30