Retail Post; Aadhaar Updation; Post Office Passport Seva Kendras; Gangajal Services; India Post Passenger Reservation System (PRS) Doorstep Service; Prasadam (Holy Blessing) Tools & Help. You are here Home >> Senior Citizen Savings Scheme. Senior Citizen Savings Scheme (SCSS) S.No. CIRCLE: No. Of Accounts: 1: Andhra Pradesh: 1918: 2: Base: 0.. Before submitting the 15H Form online for the said reason, check the eligibility factors thoroughly. The EPF balance shouldn't fall in the specified tax bracket. TDS on Income from Deposits In Post Offices - Senior Citizens can submit Form 15H to the Post Office who deducts TDS on income from deposits in respective branches. Hence, they can.

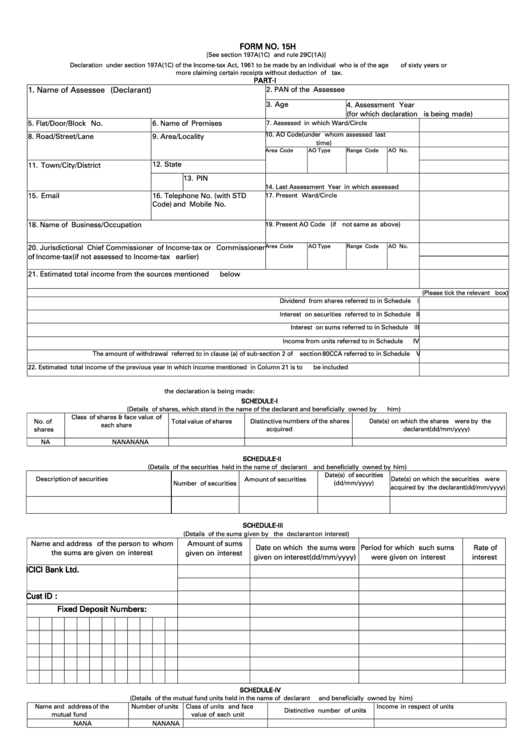

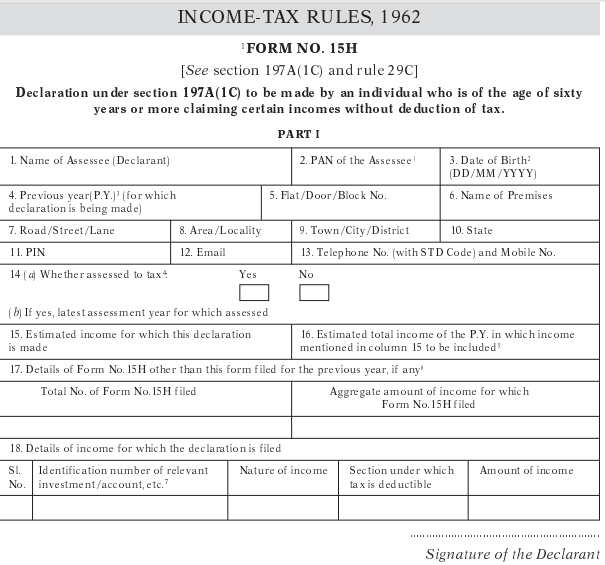

Form No. 15h Declaration Under Section 197a(1c) Of The Act, 1961 To Be Made By An

![[PDF] Jammu CoOperative Bank Form 15H PDF Download InstaPDF [PDF] Jammu CoOperative Bank Form 15H PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/the-citizen-co-operative-bank-form-15h-732.jpg)

[PDF] Jammu CoOperative Bank Form 15H PDF Download InstaPDF

Form 15H for senior citizen FY 2020 21 How to Save TDS Senior Citizen form 15H fill up YouTube

Pdf Form H For Pf Withdrawal Pdf Download In English Instapdf SexiezPix Web Porn

Senior Citizen Saving Scheme (SCSS) 2024 Forms, New Rules, Interest Rate, Min Deposit Amount

How to Fill Form 15H for Senior Citizen 2023 কিভাবে 15H ফর্ম পূরণ করবেন ? 15H Form Fill Up

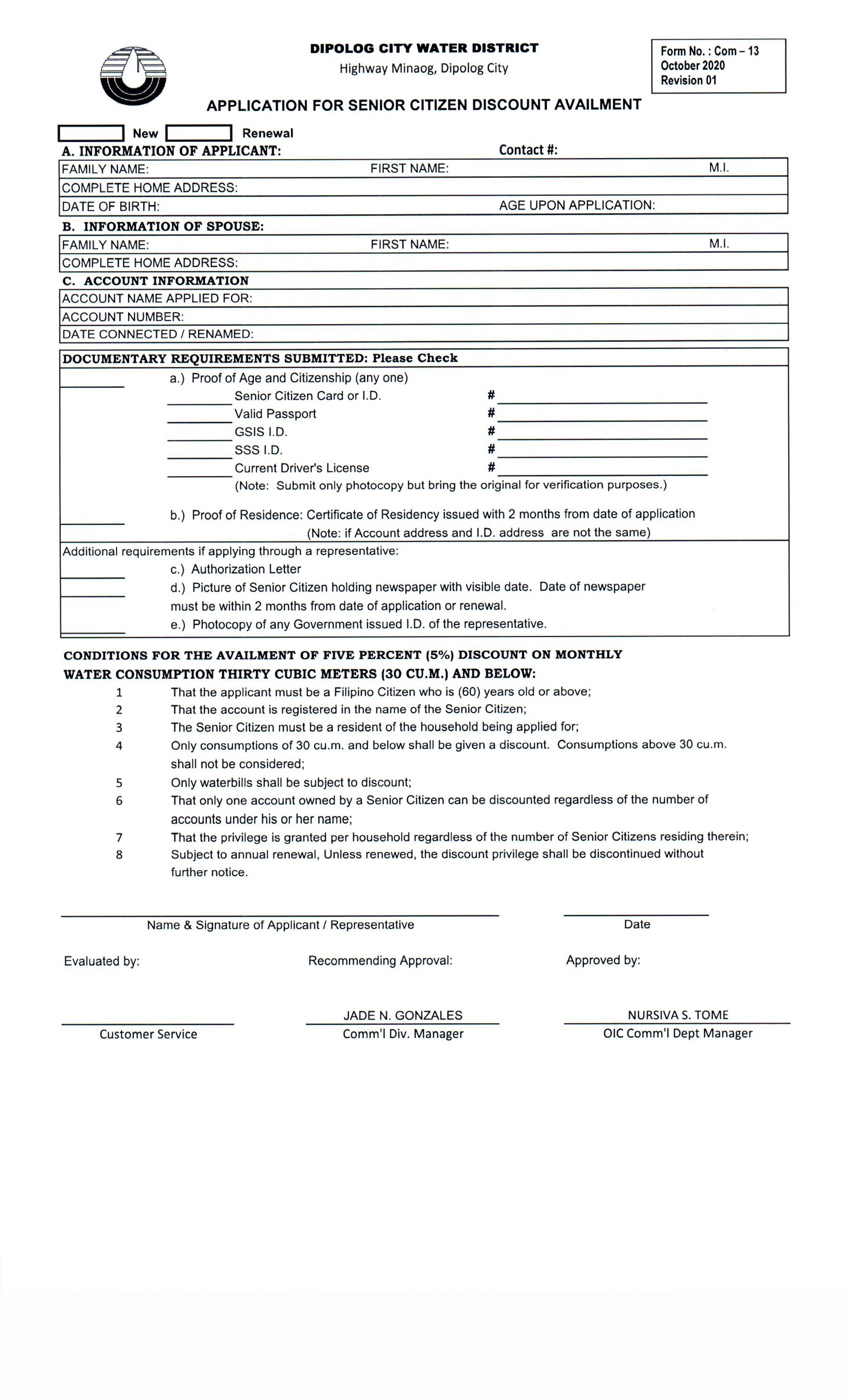

Downloadable Forms Dipolog City Water District

What is form 15G/15H?

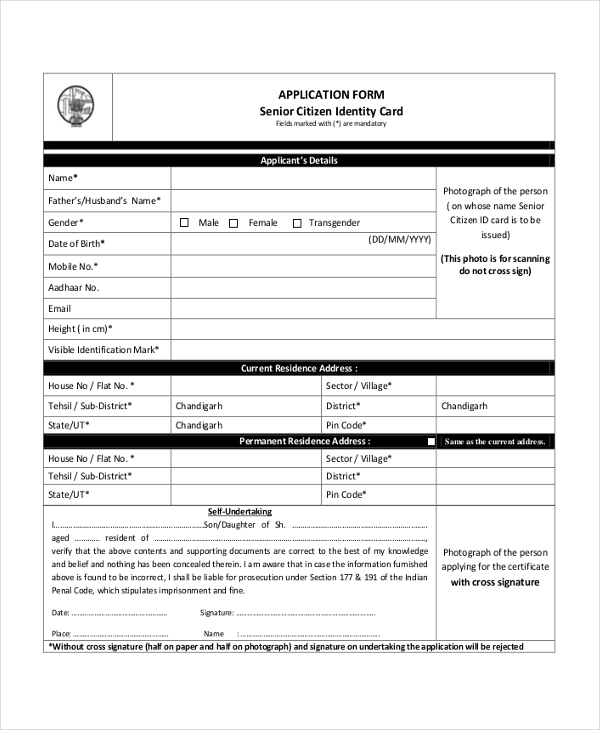

citizenship pdf form

How to Fill Form 15H for Senior Citizen ArijitChakrabortysongs TDS on Bank Interest 15H Form

How To Fill Form 15H Tax Form 15H How To Fill Senior Citizen Form 15H YouTube

How to Fill Form 15H for Senior Citizen How to efile Form 15H on Tax Portal SVJ

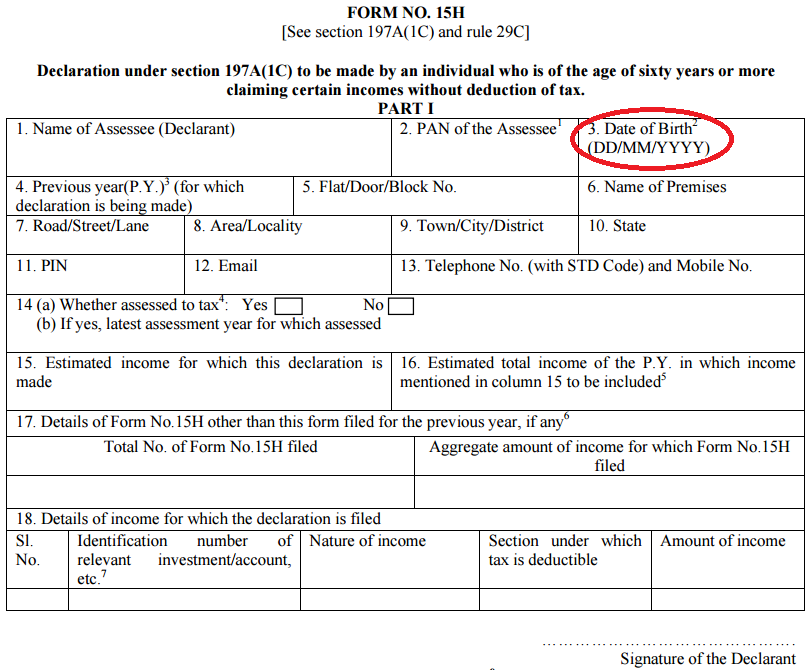

Form No 15H Declaration under section 197A(1C) to be made by an individual who is of the age

Senior Citizen Data Form

Form 15h Last Date 2023 Printable Forms Free Online

15h fillable Fill out & sign online DocHub

Senior Citizen Savings Scheme in Post Office Banking Tides

Senior Citizen Form BSA Barangay San Antonio Pasig City

How to Update form 15H and PAN Number in Post Office (DOP) SCSS accounts TDS Deduction in Post

How to fill Form 15H (English) Save TDS on FDs Senior Citizens Save Tax YouTube

15. Estimated income for which this declaration is made. 16. Estimated total income of the P.Y. in which income mentioned in column 15 to be included5. 17. Details of Form No.15H other than this form filed for the previous year, if any6. Total No. of Form No.15H filed. Aggregate amount of income for which Form No.15H filed.. Benefits of Form 15H for Senior Citizens. Filing Form 15H provides several benefits for senior citizens in their tax planning and compliance efforts. Here are some key advantages of submitting Form 15H: 1. Avoiding TDS Deduction. By submitting Form 15H, senior citizens can ensure that no TDS is deducted on their interest income.