How to get your credit union car loan. You could get a competitive rate online in a matter of minutes. You pick the term that works best for your monthly budget. Get a preapproved car loan. Submit an online loan application or apply by phone at 800-328-1935 (available 24/7).. The most popular reason to get your car loan from a credit union is so you can pay a lower interest rate. You can pay a lower interest rate than you would through your bank or with the financing.

5 Benefits of Securing a Car Loan from a Credit Union Kansas City Credit Union

Qualifying for a Navy Federal Credit Union car loan as both a home owner and a renter at the

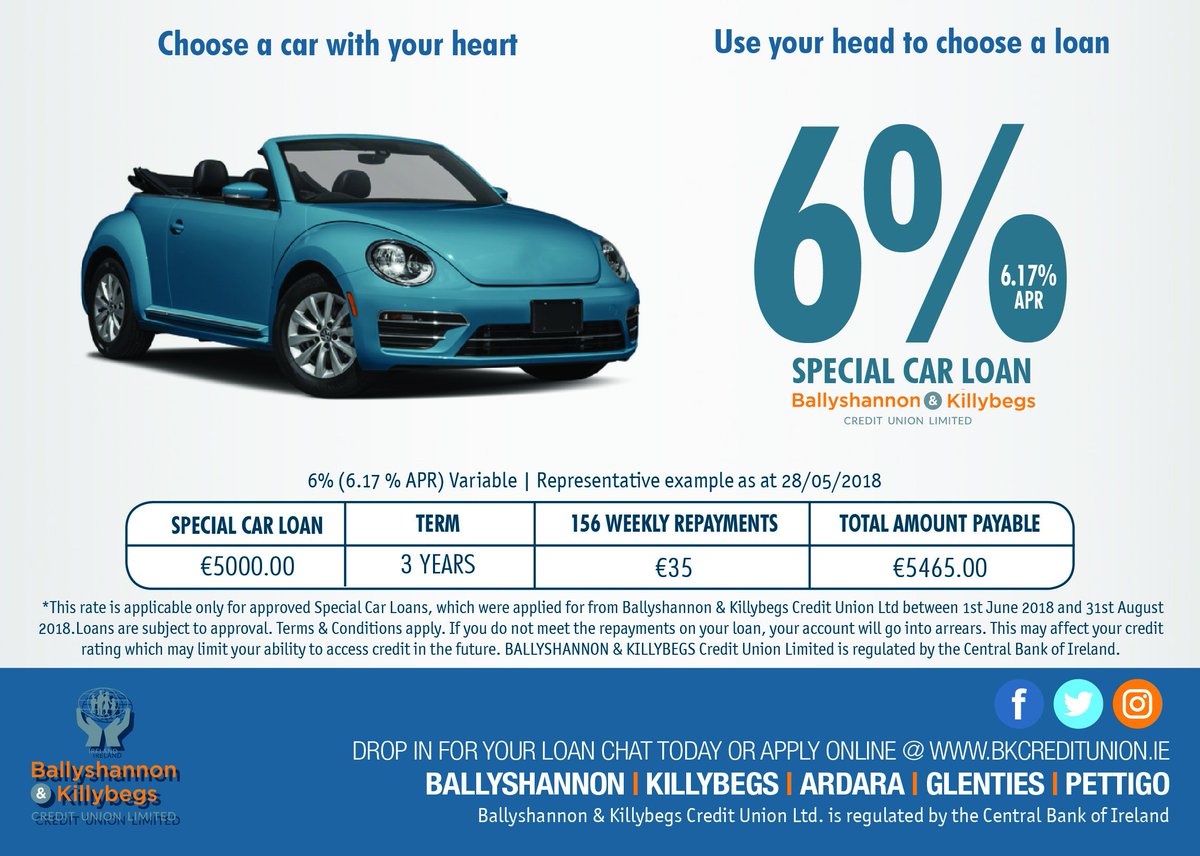

New Car Loan Rate Mulcair Credit Union Limited

Applying For A Car Loan Through A Credit Union Loan Walls

Cloudy forecast for credit union auto lending in 2020 Credit Union Journal

Best Credit Unions for Car Loans of 2024

WHY YOU SHOULD GET A CAR LOAN FROM A CREDIT UNION Vibewow

Car Loan Credit Union Guide to Affordable and Flexible Car Financing

Credit Union Car Loan YouTube

Credit Union Car Loans 1st Ed Credit Union

Credit Union Car Loan YouTube

Credit Union loan is the first port of call for Car Finance Enniscorthy Credit Union Ltd

Credit Union Car Loans Alliant Credit Union

Credit Union Car Loan Your Ethical Alternative to Car Finance

Credit Union Auto Loan The Ultimate Guide for 2023 SuperMoney

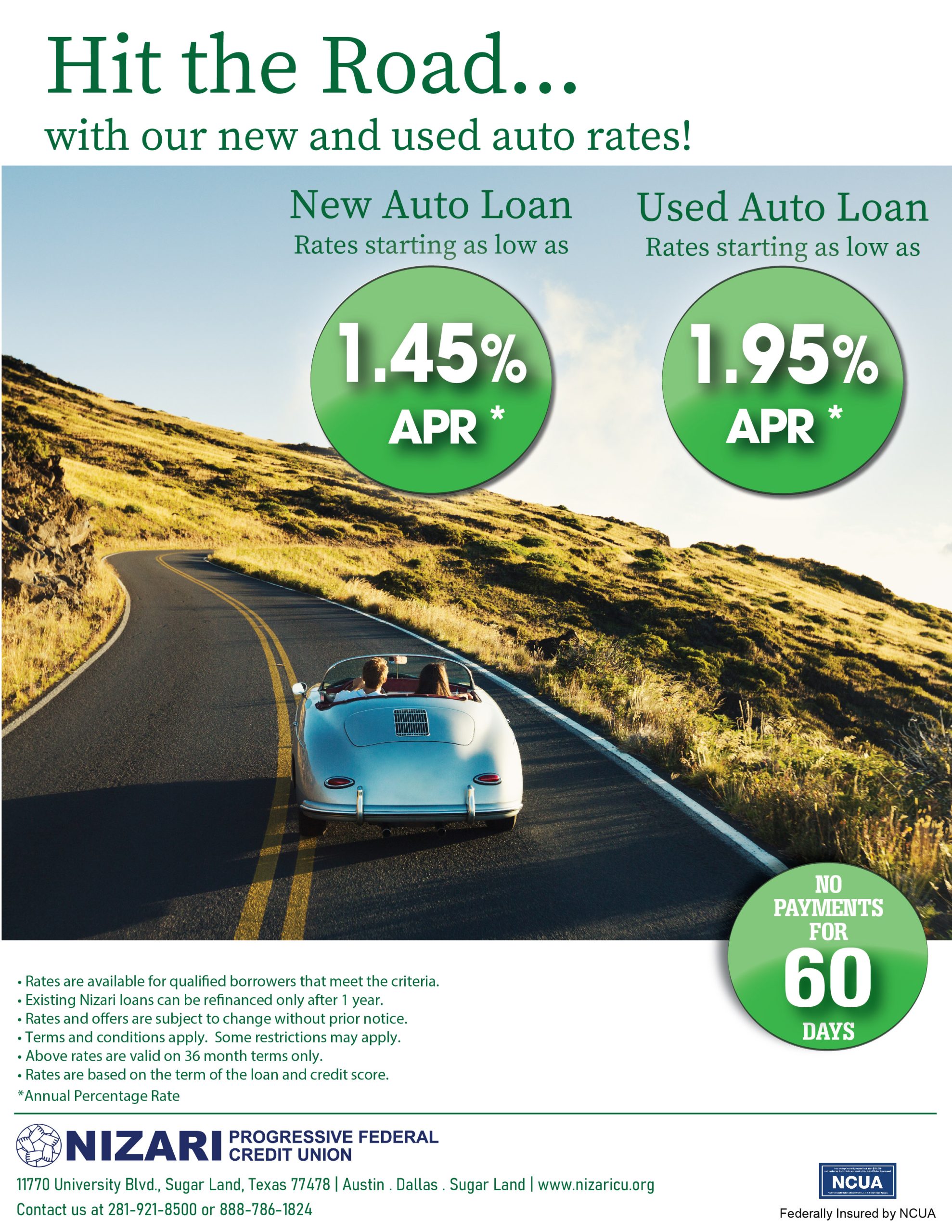

Auto Loans Nizari Credit Union

Credit Union Car Loan Rates Utah Navy Federal Credit Union Car Loan Reviews TBC Apply now

CU Solutions Group How One Device Can Help Grow Your Credit Union’s Auto Loan Volume Car

6 Reasons To Get A Credit Union Car Loan

Best Credit Union For Car Loan Near Me Loan Walls

3. Lower Loan Minimums. 4. Local, Personalized Service. Frequently Asked Questions. With the average price of a new car hovering around $45,000, finding an affordable auto loan is critical. If you've been searching for the best interest rates and terms, chances are good you've come across auto loans from credit unions.. Car loans from Consumers Credit Union are available nationwide and range from $500 to $350,000, making it an option for many borrowers; you'll find new, used, and refinance loans available. This lender also offers a relatively fast funding time, with loan funds available as soon as one day after approval. Rate discounts are available for.